While the GST implementation initially posed challenges for businesses in terms of understanding the new compliance requirements and adapting to the changes, it has gradually settled into the Indian tax landscape.

Since its implementation, the Indian GST has undergone various amendments and refinements based on feedback from businesses and the evolving economic scenario. GST Network (GSTN), a not-for-profit company, was created to provide the IT backbone for the GST system, including taxpayer registration, return filing, and tax payments.

To prepare for the implementation of GST, extensive efforts were made to build the necessary technological infrastructure and train tax officials and businesses. Compensation cess is being levied on demerit goods and ceratin luxury items. Some essential commodities are exempted from GST, Gold and job work for diamond attract low rate of taxation. Under the Indian GST, goods and services are categorized into different tax slabs, including 5%, 12%, 18%, and 28%. On 1 st July, 2017, GST laws were implemented, replacing a complex web of Central and State taxes. It played a crucial role in shaping the GST framework in India. The GST Council, consisting of the Union Finance Minister and representatives from all States and Union Territories, was established to make decisions on various aspects of GST, including tax rates, exemptions, and administrative procedures.

For assisting the GST Council, the office of the GST Council Secretariat was also established. Further, the Bill has been ratified by the required number of States and has since received the assent of the President on 8 th September, 2016 and has been enacted as the 101st Constitution Amendment Act, 2016. The Bill with certain amendments was finally passed in the Rajya Sabha and thereafter by the Lok Sabha in August, 2016. The Constitution Amendment Bill was passed by the Lok Sabha in May, 2015. The Bill aimed to amend the Constitution to enable the implementation of GST. The Constitution Amendment Bill was introduced in 2011 but faced challenges regarding compensation to States and other issues.Īfter years of deliberation and negotiations between the Central and State Governments, the Constitution (122 nd Amendment) Bill, 2014, was introduced in the Parliament. The Empowered Committee of State Finance Ministers prepared a design and roadmap, releasing the First Discussion Paper in 2009. The objective was to replace the prevailing complex and fragmented tax structure with a unified system that would simplify compliance, reduce tax cascading, and promote economic integration. Wirebound, nonrefillable planner also features a simulated leather cover and storage pocket.The idea of a nationwide GST in India was first proposed by the Kelkar Task Force on Indirect taxes in 2000.

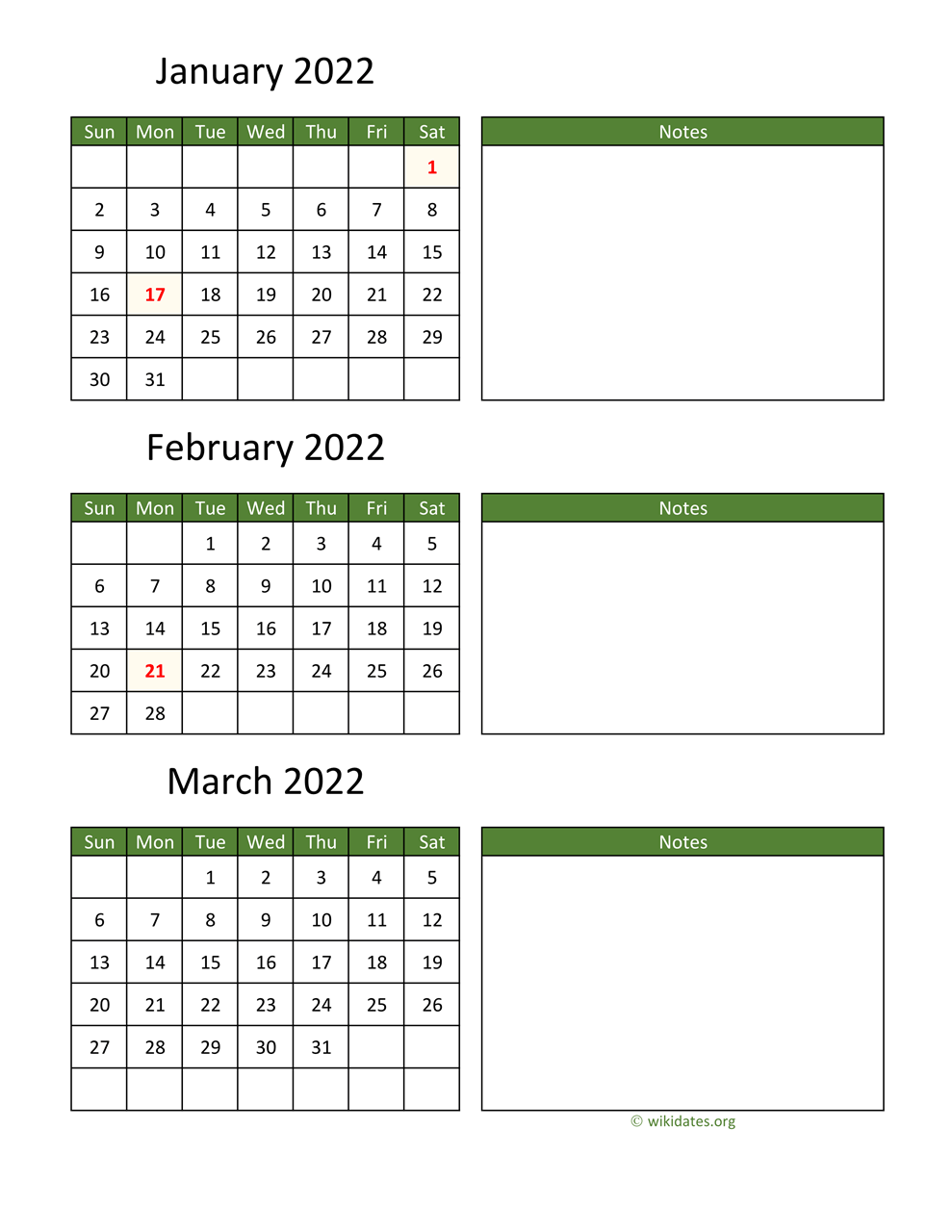

The monthly calendar includes ruled daily blocks, Sunday-through-Saturday scheduling, shaded weekends and holidays.

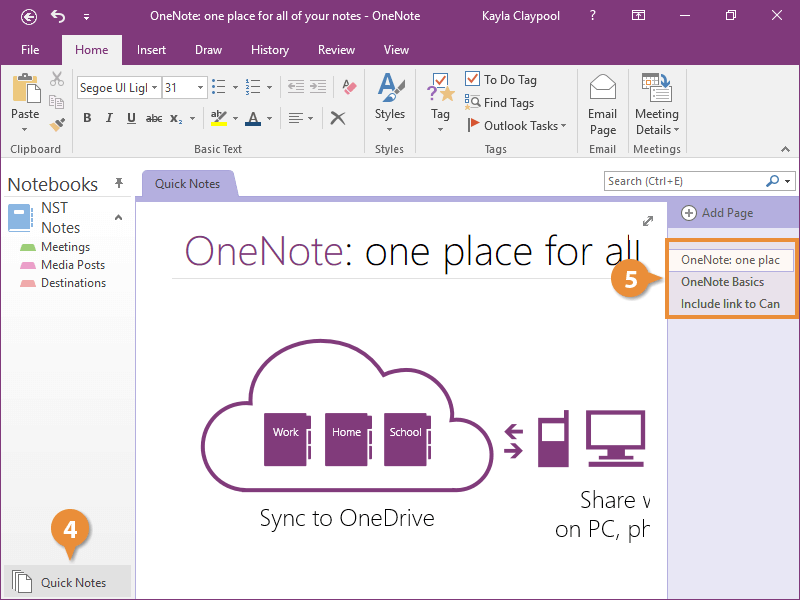

#AT A GLANCE QUICK NOTES 2022 FULL#

Tabbed, two-page-per-month overview offers a full-page QuickNotes area for planning, a full monthly calendar on the left page and two past and six future months reference across both pages. Two-page-per-week spreads include ruled daily columns, quarter-hourly appointment times from 8 AM to 8:45 PM every day, Monday-through-Sunday scheduling, count of days/days remaining, numbered weeks, holidays, and QuickNotes column for notes. Dated planning pages range 12 months from January to December. QuickNotes weekly/monthly planner offers a way for you to schedule your busy week and plan for a busy month. General Information Manufacturer:ACCO Brands Corporation Manufacturer Part Number:76-950-05 Manufacturer Website Address: Brand Name:At-A-Glance Product Line:QuickNotes Product Name:Quicknotes Weekly/Monthly Appointment Book Marketing Information:

0 kommentar(er)

0 kommentar(er)